Financial Independence Defined

Financial independence is the point at which your savings and investments generate enough income to equal or exceed your employment income. Or more specifically, the point at which they generate sufficient cash flow to cover the costs of your lifestyle. At this point, work becomes a choice and not a necessity. In this text, we will address the methodology of achieving financial independence. In the past I jokingly said, “Financial independence is best achieved via the proper selection of one’s parents.” Now I jokingly say, “All I want for my children is that they have parents of immense wealth.” In reality, we know that inheriting wealth can be a mixed blessing—hence the need to acquire the wisdom and skills for independently achieving wealth first.

Financial Independence—Formula 15

Think for a moment about your favorite cake. Perhaps your mom or your grandmother made it for you. You know that in order for that cake to be delicious, she had to follow a certain recipe. And within that recipe were the key ingredients. The three ingredients that make up the formula for financial independence are:

- Savings amount

- Investment return

- Time

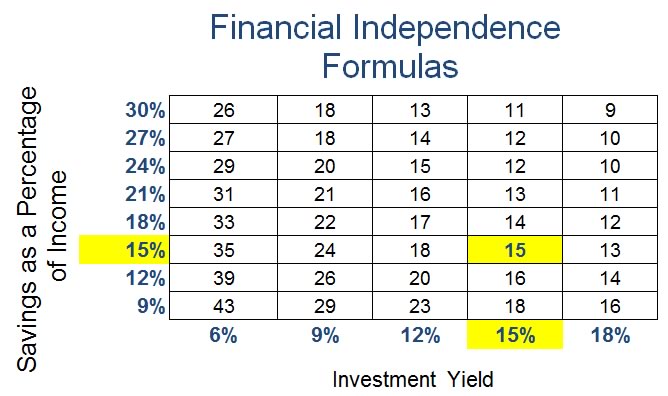

Basically, if you save a given percentage of your income and can earn a given yield on your savings and investments, you will amass an investment portfolio large enough to produce income to meet your lifestyle within a determinable number of years. Naturally, the more you save and the higher your investments yield, the sooner you will achieve financial independence. Thus unlike a cake recipe, the ingredients can be variable. There can be many different formulas that will achieve the intended results, but the following one is probably the easiest to understand and remember. Formula 15 simply stated is:

Basically, if you save a given percentage of your income and can earn a given yield on your savings and investments, you will amass an investment portfolio large enough to produce income to meet your lifestyle within a determinable number of years. Naturally, the more you save and the higher your investments yield, the sooner you will achieve financial independence. Thus unlike a cake recipe, the ingredients can be variable. There can be many different formulas that will achieve the intended results, but the following one is probably the easiest to understand and remember. Formula 15 simply stated is:

Save/invest 15% of your income

Earn a yield of 15% on these savings/ investments

You will be financially independent in 15 years

Right about now, you may be thinking that this concept is just a fantasy. It’s not. We must be careful though not to set unrealistic expectations, like averaging investment returns of 15%. Bear with me for a bit and we’ll get to that and a number of other challenges.

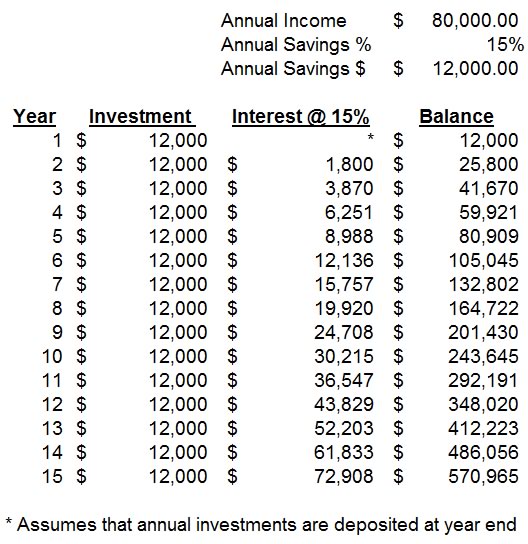

The formula works at any level of income. For example, if you earn $80,000 per year, and save 15% of that amount, you are investing $12,000 per year towards your financial independence. If you average a 15% rate of return on your investments, in 15 years you will accumulate over $570,000. If that $570,000 continues to generate a 15% yield, it will produce over $80,000 per year in earnings from which you can support your lifestyle.

Here’s the schedule:

The formula can be modified by changing the savings amount and/or yield, which will result in a different outcome in terms of years to financial independence. The following matrix provides a sampling of additional formulas:

Use this link: Financial Independence Formulas for an expanded matrix of the formulas. Achieving financial independence sounds easy enough, right? Not really. You are probably already thinking of the challenges. Let’s discuss them:

Challenges to Formula 15

There are four main challenges to the successful execution of this formula. Remember them easily with the acronym “DIRT.” You probably expect the D to stand for debt. That’s a part of it, but the word we’re looking for here is discipline. We discuss discipline (or the lack thereof) throughout this text as the number one barrier to achieving financial independence. It’s not easy to set aside 15% of your income and then leave it alone for 15 years. If you disturb your favorite cake before it rises, it can be ruined. So you have to be patient. Likewise, you need to allow your financial independence fund to rise to its goal before tasting of its benefits.

There are many demands on our cash flow, and the temptation to spend it all—and yes, even beyond (via the use of debt)—can be a challenge for all of us. Thus discipline is crucial, and it helps if we establish our priorities. We know that the government will get its share first (in the form of income taxes) before we ever see the net amount of our paychecks. Upon receipt of our net amount, one of our first priorities should be saving toward our financial independence. The principle here is to learn to pay yourself, immediately after paying taxes to the government and tithing to God. Prioritization is one of the most critical elements of our cash-flow strategy.

And of course, avoiding consumer debt is another important part of discipline. If you allow credit card interest to consume any amount of your income, your cash flow can be severely cramped. Think about it: just as the math of compound interest can work for you in amazing ways, so does it work the same for the credit card companies—but at your expense. Don’t ever allow credit card companies to charge you interest! Never purchase anything with a credit card unless you know that you will be able to pay for it in full when the statement arrives at the end of the month.

And of course, avoiding consumer debt is another important part of discipline. If you allow credit card interest to consume any amount of your income, your cash flow can be severely cramped. Think about it: just as the math of compound interest can work for you in amazing ways, so does it work the same for the credit card companies—but at your expense. Don’t ever allow credit card companies to charge you interest! Never purchase anything with a credit card unless you know that you will be able to pay for it in full when the statement arrives at the end of the month.

The second challenge is inflation. We know that 15 years from now, $80,000 won’t purchase what it does today. The primary way we overcome inflation is quite natural: If we save 15% of an ever-increasing salary, the amount invested each year will increase, hopefully in step with or ahead of inflation. This, along with enhanced investment returns, is what’s required to offset the effects of inflation.

The third challenge is risk. In order to generate a 15% rate of return, to what kind of risk must we subject our investments? For that matter, are there investments that consistently produce a 15% yield? The stock market (S&P 500) has averaged 11.07% over the last 40 years, and bonds have produced only a 7.36% return over the same period (Barclays U.S. Agg)[15]. And these returns have not been without risk.

Candidly, there are few investments that have generated a 15% rate of return (for more than short periods of a time) without being leveraged. And consistently earning double-digit returns, even for leveraged investments, is a tall order. An example of leverage would be real estate investments in which the bank provides a significant portion of the working capital. We’ll spend some time in the next chapter discussing leverage and investment strategies for enhanced returns and reduction of risk.

Regardless, your personal plan of financial independence should not assume a consistent 15% annual increase in your investments. Formula 15 is a hypothetical example of how the three components (savings amount, yield, and time) can converge for an easy to remember concept.

Something else to keep in mind; it is prudent to reduce the risk exposure as you get older and especially as you enter your retirement years. And often, with reduced risk comes reduced investment yields. Formula 15, and all the formulas on the matrix above, assume that the investment yields stay the same after retirement. If you lower the yield assumption for the years when you are drawing from the portfolio, a larger amount of capital will be required. For example if you decide to draw 4% from your portfolio (a standard practiced by many advisors), then in order to receive $80,000 in annual income you will need to have $2 million in your retirement portfolio. That’s substantially more than the $570,965 accumulated in the earlier example.

Don’t be discouraged by this. You’ll find that as time goes by and you build your investment skills, accumulating a multi-million dollar investment portfolio isn’t all that difficult. Keep in mind also that there are other sources to help supplement your retirement income goal such as Social Security, pensions, inheritances, etc.

Don’t be discouraged by this. You’ll find that as time goes by and you build your investment skills, accumulating a multi-million dollar investment portfolio isn’t all that difficult. Keep in mind also that there are other sources to help supplement your retirement income goal such as Social Security, pensions, inheritances, etc.

You may be wondering why the draw rate is only 4%? Is that all one could hope to earn on their investments during retirement? No, a conservative portfolio will hopefully earn 6-7% or perhaps more. The reason for drawing only 4% is that you will want to allow some of the interest to accumulate and grow the principal so that larger amounts can be withdrawn over the years to adjust for inflation. The typical intent is to keep principal intact for life and then pass it to heirs and/or charity afterwards. In later years, a higher draw rate is acceptable, and even some invasion of principal.

It’s not difficult to calculate the draw amount that will keep principal from running out until a specified age, such as age 100. See examples here.

The final challenge is taxes, the T in D.I.R.T. We know that federal and state governments will demand a part of these earnings, and our compliance is to be expected:

Pay to all what is owed to them: taxes to whom taxes are owed…

—Romans 13:7 (ESV)

Fortunately, the tax laws offer a number of methods by which to defer taxes and even enjoy tax-exempt earnings. Check with your advisor about the use of 401(k)s, IRAs, 457 plans, 403(b)s, and other savings plans to defer taxes and earn compound interest for yourself on those deferred amounts. To exempt earnings from taxes, look into the Roth IRA and municipal bonds.

The above is only a brief overview of the challenges in Formula 15. For now, suffice it to say that they are formidable and require a considerable amount of thought and effort to overcome.

The purpose of this chapter is to whet your appetite for the possibility of achieving financial independence by utilizing one of many available formulas.

Seek wise, professional assistance, especially as your resources increase, and together you and your advisor can arrive at a plan that will enable you to optimize a customized version of the Formula 15 strategy that will put you on a path toward financial independence.